Save more for retirement with your employer-sponsored plan and AmeriLife® Benefits Retirement Services

- Broad selection of quality, brand-name investments, plus fixed indexed annuities (FIAs)

- Retirement planning tools and support to help you make informed decisions

- An easy-to-use, retirement savings platform available, online, via your smartphone, tablet, or computer

Why contribute to both the state and your employer-sponsored plan?

The TRSL (or LASERS) defined benefit retirement program provides a valuable source of ongoing retirement income for Louisiana public employees. However, it may not provide enough income to ensure a financially secure retirement as it is intended to only replace a portion of your income.

You will pay federal taxes on your TRSL income, and with no social security benefit, longer life expectancies, and increasing inflation and cost of living you should consider saving more through the Washington Parish School System plan.

Already Enrolled?

Click below to access your retirement account on the IPX platform.

Not Enrolled Yet?

Please contact us at

(833) 586-7526 or click below to schedule an appointment.

Multiple savings opportunities on one platform

Manage your retirement savings account on the IPX platform

The IPX platform gives you powerful access to manage your retirement account online – using your smartphone, tablet, or computer. The IPX team is available year-round to assist you with your accounts, transferring retirement assets, and more.

With your online account, you can:

- View your current investment balances, holdings, and performance

- Review available investment products and information

- Update your investment directions, including elections, reallocation, and rebalancing

- Generate online statements and view transaction history

- Access a financial wellness center that includes videos, calculators, and articles

Investment Accounts

From Brookstone Capital Management, a national financial advisory firm and Registered Investment Adviser.

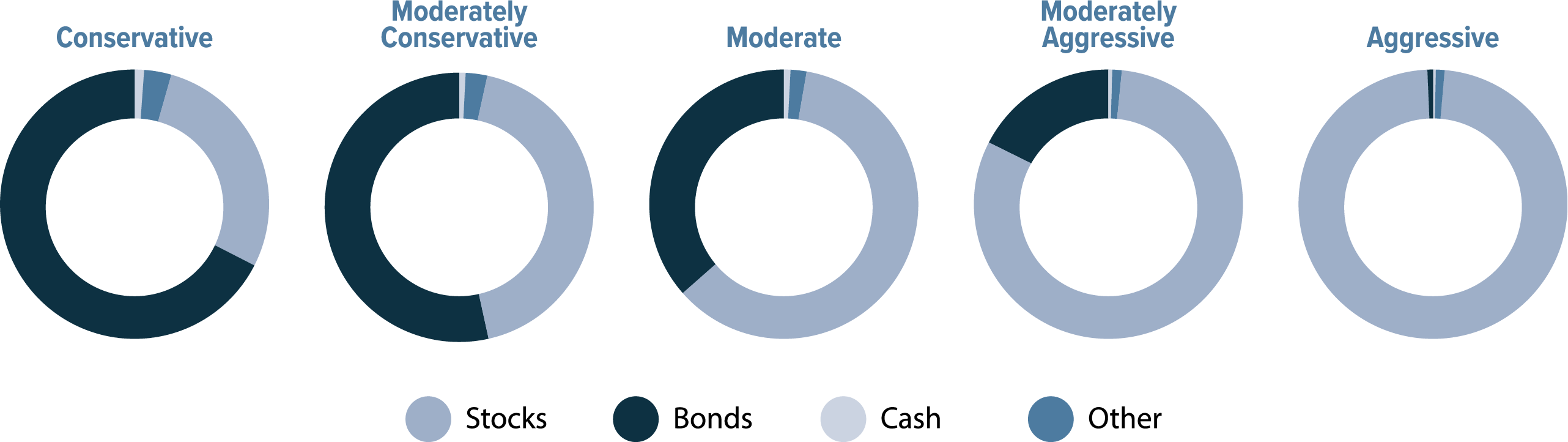

- RAISETM Star Series of professionally managed investment portfolios: five risk-adjusted models from conservative to aggressive. For those who wish to rely on the services of Brookstone investment professionals.

- Self-selection of investments: choice of a fixed-interest stable value fund and 40 individual mutual funds and exchange-traded funds (ETFs) from trusted institutions, such as Vanguard, American Funds, Invesco, BlackRock, and Fidelity.

Fixed Indexed Annuities

From National Life Group, the #1 issuer of FIAs in employer-sponsored plans.1

Fixed indexed annuities can provide potential for higher interest crediting than traditional fixed annuities, and minimum guaranteed accumulation value and safety of premiums paid and interest earned.

FIT Select Income

with a Guaranteed Lifetime Income Rider

Help your savings become retirement income that you can never outlive, while still retaining access to the remaining cash value.

FIT Secure Growth

Boost your interest rate potential and opportunity for growth, while never losing a penny and adding stability to your retirement portfolio.

Life Insurance Company of the Southwest® (LSW), a member company of National Life Group, offers flexible premium indexed annuities (FIAs) for 403(b)/457 plans. LSW has a financial strength rating of A+ (Superior, 2nd highest out of 16 rankings) by AM Best.2

Getting Started

Need help setting up an account and deciding how to invest your contributions?

Schedule an appointment with an AmeriLife Benefits program Investment Adviser Representative (IAR) – at no charge to you – to guide you through your savings options, open an account, and complete a salary reduction agreement.

Call AmeriLife Benefits at (833) 586-7526 or click below.

Enroll and make investment selections on your own

You also have the option of opening an account and investing in the selection of mutual funds and exchange-traded funds without the assistance of an Investment Adviser Representative (IAR).

Note: An appointment with an IAR is required to begin contributing to one of the annuities in the program.

A 3-step process:

- Register and open an account in the IPX platform

- Make investment selections in the IPX platform

- Complete the online salary reduction agreement (SRA) with TSACG*

What is an Investment Adviser Representative (IAR)?

An IAR is in the business of providing advice regarding securities, and has a fiduciary and regulatory responsibility to:

- Put their clients’ interest first

- Register under the Uniform Securities Act

- Pass the Series 65 (or Series 66) securities license exam (unless a waiver is obtained)

Agents who reference themselves as “financial advisors” are not IARs unless they meet the above requirements.

Get the help you need to feel confident in your retirement savings.

Resources

*US OMNI & TSACG Compliance Services (TSACG)

TSACG is one of the nation’s largest independent service providers for retirement plans sponsored by public education employers. TSACG provides salary reduction administration and plan compliance services for the Washington Parish Schools System’s 403(b)/457 retirement plans. The online salary reduction agreement should be used for contributions to all providers in the plan, with 100% of your requested regular salary reduction amount spread across the designated providers. Questions? Call TSACG at (888) 796-3786, option 5.

Program charges & fees

Charges and fees are based on individual annuity and investment selections.

- An annuity withdrawal charge and optional rider charges may apply. See annuity product sales material for more detail.

- Contributions to a Brookstone advisory account incur an annual investment account charge of $55 per participant per plan, and an annual advisory fee of 1% of the total value of the account assets.3 Mutual funds and ETFs have separate investment management fees as indicated in the prospectus.

Not affiliated with the U.S. Government.

- LIMRA US Individual Annuity Industry Sales Report, 4Q2021

- As of 04/01/2022. Ratings are subject to change. TC126123(0422)1

- Advisory fee is calculated based on the average daily balance during the current quarter and deducted quarterly.

- This information is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. All investment and/ or investment strategies involve risk including the possible loss of principal. There is no assurance that any investment strategy will achieve its objectives. Past performance is not a guarantee of future results. No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. The information provided does not take into account your particular investment objectives, financial situation or needs and is not suitable for all investors. For a complete description of investment risks, fees and services review the Brookstone Capital Management firm brochure (ADV Part 2) which is available from your Investment Adviser Representative or by contacting Brookstone Capital Management. Exchange traded funds (ETFs) and mutual funds are offered by prospectus only. Investors should consider a fund’s investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other important information is available and should be read carefully before investing.

Investment advisory services are offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and AmeriLife are separate companies, but are affiliated through common ownership. Insurance products and services are not offered through BCM, but are offered and sold through individual licensed and appointed agents. Not affiliated with Social Security, Medicare or any other federal program