Health Savings Account

EMPLOYEE MUST BE ENROLLED IN QUALIFIED HDHP TO PARTICIPATE – State Health Plan Legacy Base or Horizon Base are the qualified.

Health Savings Accounts (HSA) allow you to set aside money from your paycheck on a pre-tax basis to pay for your out of pocket medical, dental and vision expenses. That means you do not have to pay federal, state or FICA taxes on these dollars….which means you have more money in your pocket! Most people can save 25% on each dollar that is set aside, for expenses they are paying for anyway!

H S A is through FlexMade Easy

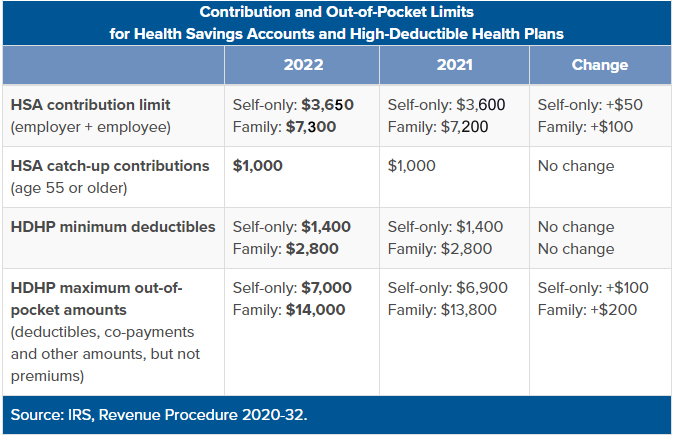

2022 Maximums:

- Individual: $3650

- Family: $7300

- Catch Up: $1000 (over age 55 can contribute an additional amount)

Can NOT enroll in Medical FSA (Medical Flexible Spending Account) if enrolled in H S A.